Ivana Lotoshynski, CFP®

Ivana Lotoshynski, CFP®

People Wealth Matters

Financial Advisor

https://peoplewealthmatters.com

ilotoshynski@peoplewealthmatters.com

Quarterly Market Insights | Q4 2023

U.S. Markets

Stocks moved higher in the final three months of the year as bond yields trended lower in growing anticipation of a potential Fed easing.

For the three months ending on December 31, the Dow Jones Industrial Average gained 12.5 percent while the Standard & Poor’s 500 Index picked up more than 11 percent. The Nasdaq Composite, which led throughout 2023, led again, tacking on nearly 14 percent.1

“Discipline is the bridge between goals and accomplishments.”

Jim Rohn, entrepreneur, author and motivational speaker

A Shaky Start

As satisfying as the fourth quarter’s results were, the quarter began in an unpromising fashion.

Strong economic data released in October stoked investors’ fears that the Fed would be unable to ease its tight monetary policies, sending bond yields to heights not seen in more than a decade. Concerns over Treasury funding and higher-than-expected consumer price inflation added to the gloom that gripped stocks during the first month of the fourth quarter.

November Turning Point

But markets turned in November, rallying on fresh data that showed renewed inflation progress and constructive comments from Fed Chair Jerome Powell. These positive developments sparked a retreat in bond yields and a celebration in the stock market.

In a month’s time, pessimism over conditions potentially holding back the Fed from easing its restrictive policies faded, replaced by optimism that the rate hike cycle may be finished and interest rate cuts may be in the offing in 2024.

Encouraging Earnings

Throughout the first two months, companies were reporting their third-quarter earnings. Coming into the quarter, investors had hoped that good earnings reports might serve as a catalyst to lift stocks from the doldrums of the previous months. Corporate earnings, it turns out, were not spectacular, but they offered signs of encouragement to investors.

For the third quarter, earnings grew 2.7 percent year-over-year, which was the second straight quarter of earnings growth—a welcome development after suffering an “earnings recession” (i.e., two consecutive quarters of earnings declines) previous to this. Wall Street analysts are forecasting an 11.8 percent increase in corporate profits in 2024, despite concerns about a potential recession in 2024.22

Powell’s Pivot

he momentum continued to build in December when the Federal Open Market Committee (FOMC) announced that it was leaving interest rates unchanged, and a survey of its members indicated that up to three interest rate cuts would be possible sometime in 2024. The announcement, coupled with dovish post-meeting comments from Powell, helped drive bond yields sharply lower and stocks higher.

Q4 Sector Scorecard

For the quarter, all industry sectors except Energy (−7.25 percent) ended higher, including Communications Services (+10.81 percent), Consumer Discretionary (+11.08 percent), Consumer Staples (+4.68 percent), Financials (+13.36 percent), Healthcare (+5.93 percent), Industrials (+12.44 percent), Materials (+8.90 percent), Real Estate (+17.58 percent), Technology (+17.42 percent), and Utilities (+7.47 percent).3

Yahoo Finance, December 31, 2023. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

What Investors May Be Talking About in January

One of the catalysts of last year’s market rally was excitement about the rise of artificial intelligence and its possible image on corporate earnings.

Though tech companies may be the first to benefit from AI adoption, the broader promise lies in what it can do for workers and non-tech companies. Much like electricity and computers, AI is beneficial to more than just utility companies and computer manufacturers.

Investors may pay close attention to how non-technology companies invest in AI as 2024 progresses. Companies making commitments might signal to investors that they have potential productivity advances and future competitiveness. The risk for investors is that the hype races ahead of the reality, and the enthusiasm fades.

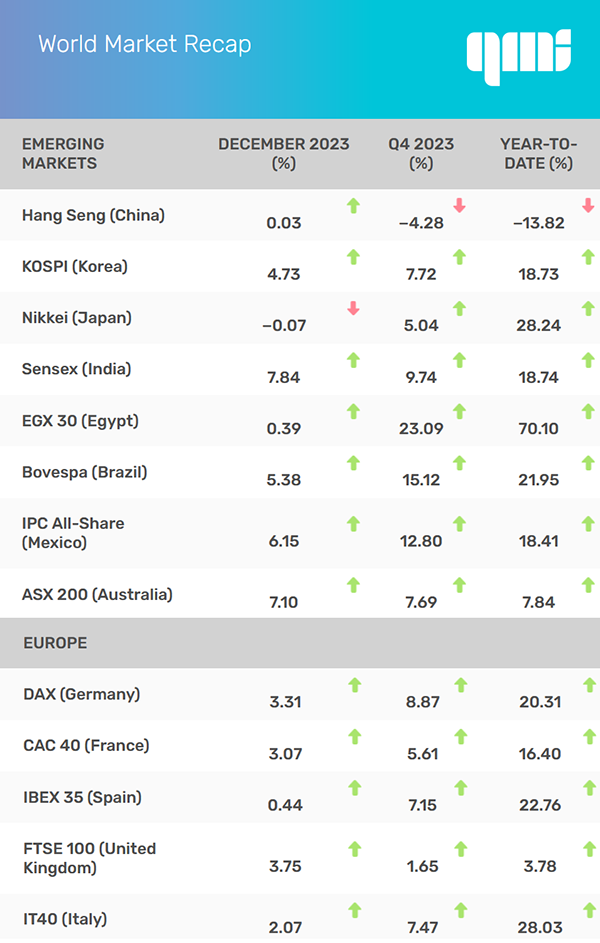

World Markets

The MSCI-EAFE gained 10.10 percent in the fourth quarter thanks to falling inflation, lower yields, and a weakening U.S. dollar.4

Sharp declines in European inflation fed optimism of rate cuts, sending European stocks higher for the quarter, with advances in France (+5.61 percent), Germany (+8.87 percent), Italy (+7.47 percent), and Spain (+7.15 percent). The U.K., which lagged for most of the year, gained 1.65 percent.5

Pacific Rim markets were mostly higher for Q4. Australia picked up 7.69 percent, while Japan added 5.04 percent. The Hang Seng Index trailed with a drop of 4.28 percent, owing to Moody’s downgrade of China’s debt and new government restrictions on gaming.6

Yahoo Finance, December 31, 2023. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Indicators

Gross Domestic Product (GDP)

Q3 economic growth was revised lower, from a 5.2 percent annualized pace to 4.9 percent, primarily due to a downward revision of consumer spending.7

Employment

Employers added 199,000 jobs in November, which was lifted by the return of 30,000 striking auto workers. The number was slightly above the consensus estimate of 190,000. The unemployment rate dropped to 3.7 percent, while wage growth (+0.4 percent month-over-month) was in line with expectations.8

Retail Sales

Retail sales rose 0.3 percent in November, up from a revised −0.2 percent in October. Excluding auto and gasoline sales, retail sales climbed 0.6 percent.9

Industrial Production

Industrial production rose by 0.2 percent, aided by increased manufacturing. Year-over-year, industrial production was lower by 0.4 percent.10

Housing

Housing starts topped Wall Street expectations, as new housing construction rose 14.8 percent in November.11

Sales of existing homes rose 0.8 percent in November—the first increase since May. Year-over-year sales fell 7.3 percent, the smallest drop since April 2022.12

New home sales dropped 12.2 percent in November, though they were 1.4 percent above last November.13

Consumer Price Index (CPI)

Consumer prices rose 0.1 percent in November and 3.1 percent from a year ago. Core inflation, which excludes energy and food, increased 0.3 percent month-over-month and 4.0 percent from last November. These numbers remained above the Fed’s 2.0 percent target.14

Durable Goods Orders

Durable goods orders rose 5.2 percent in November, the largest gain since July 2020. This gain was more than double the consensus estimate of 2.0 percent.15

The Fed

The FOMC elected to leave interest rates unchanged at both its October/November and December meetings.

Following its December meeting, the Fed signaled that it may cut interest rates three times in 2024. While careful not to declare a victory in its inflation battle, the Fed acknowledged that inflationary pressures have eased.16

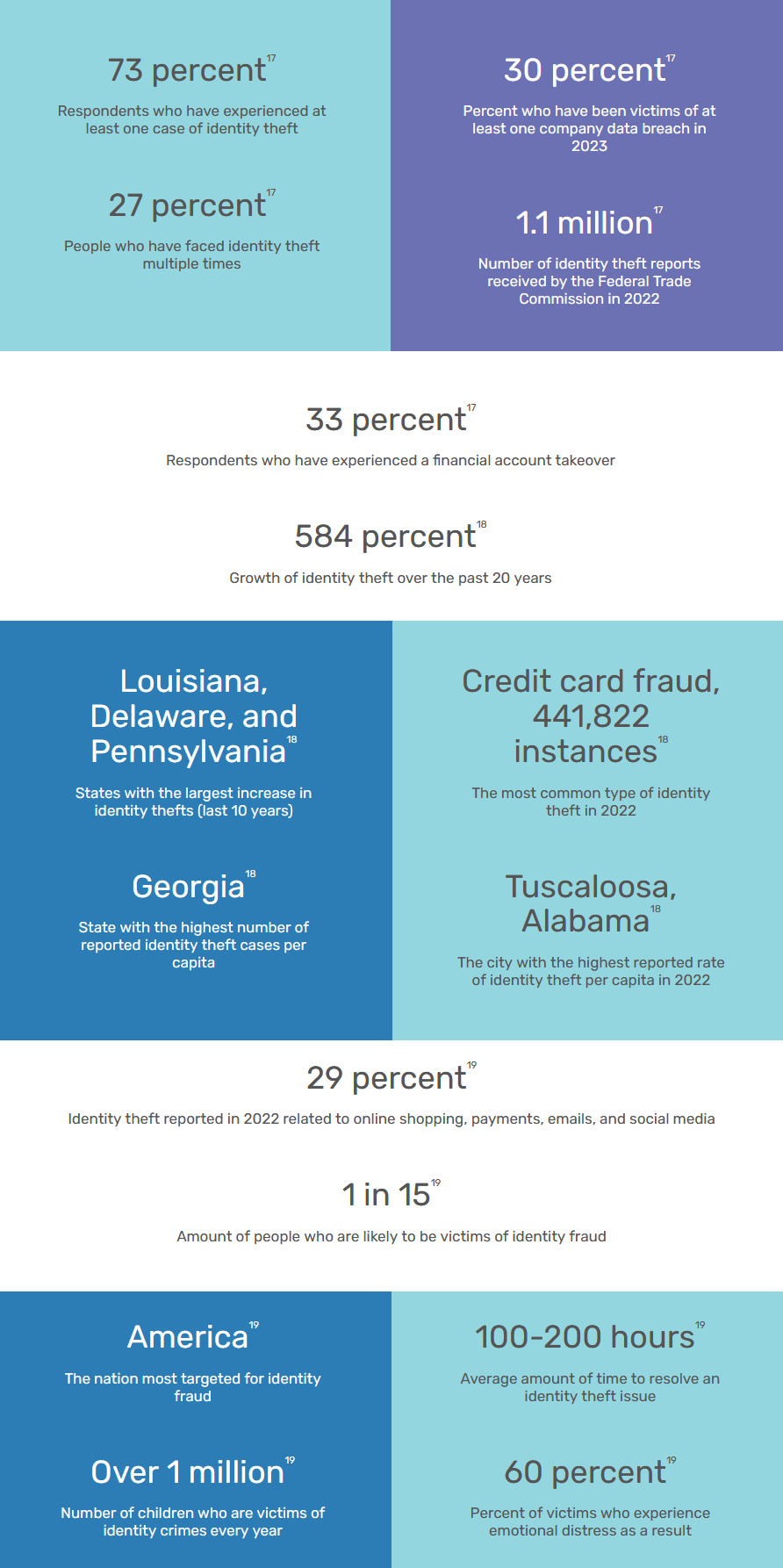

By the Numbers: Identity Theft

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, or state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Investing involves risks, and investment decisions should be based on your own goals, time horizon and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, timeframe, and risk tolerance.

The forecasts or forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The S&P 500 Composite Index is an unmanaged group of securities considered to be representative of the stock market in general. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The Russell 1000 Index is an index that measures the performance of the highest-ranking 1,000 stocks in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark for the performance in major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

The Hang Seng Index is a benchmark index for the blue-chip stocks traded on the Hong Kong Stock Exchange. The KOSPI is an index of all stocks traded on the Korean Stock Exchange. The Nikkei 225 is a stock market index for the Tokyo Stock Exchange. The SENSEX is a stock market index of 30 companies listed on the Bombay Stock Exchange. The Jakarta Composite Index is an index of all stocks that are traded on the Indonesia Stock Exchange. The Bovespa Index tracks 50 stocks traded on the Sao Paulo Stock, Mercantile, & Futures Exchange. The IPC Index measures the companies listed on the Mexican Stock Exchange. The MERVAL tracks the performance of large companies based in Argentina. The ASX 200 Index is an index of stocks listed on the Australian Securities Exchange. The DAX is a market index consisting of the 30 German companies trading on the Frankfurt Stock Exchange. The CAC 40 is a benchmark for the 40 most significant companies on the French Stock Market Exchange. The Dow Jones Russia Index measures the performance of leading Russian Global Depositary Receipts (GDRs) that trade on the London Stock Exchange. The FTSE 100 Index is an index of the 100 companies with the highest market capitalization listed on the London Stock Exchange.

Please consult your financial professional for additional information.

Copyright 2023 FMG Suite.

1. WSJ.com, December 31, 2023

2. Advantage.Factset.com, December 8, 2023

3. SectorSPDR.com, December 31, 2023

4. MSCI.com, December 31, 2023

5. MSCI.com, December 31, 2023

6. MSCI.com, December 31, 2023

7. BEA.gov, December 21, 2023

8. CNBC.com, December 12, 2023

9. WSJ.com, December 14, 2023

10. FederalReserve.gov, December 15, 2023

11. MarketWatch.com, December 19, 2023

12. Realtor.com, December 20, 2023

13. Census.gov, December 22, 2023

14. CNBC.com, December 12, 2023

15. Morningstar.com, December 22, 2023

16. WSJ.com, December 13, 2023

17. USNews.com, September 12, 2023

18. Consumeraffairs.com. April 20, 2023

19. Secloc.org, May 16, 2023