In this month’s recap: Stocks surge higher as Fed Chair Powell confirms the Fed is prepared to ease up on future interest rate hikes.

Monthly Economic Update

![]()

Presented by Ivana Lotoshynski, CFP®, December 2022

U.S. Markets

Stocks surged higher in November on rising optimism that the Fed would slow down future interest rate hikes.

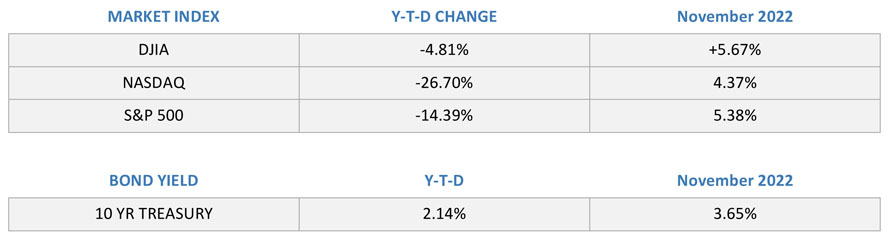

The Dow Jones Industrial Average gained 5.67 percent, while the Standard & Poor’s 500 Index picked up 5.38 percent. The tech-heavy Nasdaq Composite rose 4.37 percent.11

A Determined Fed

As expected, the Federal Open Market Committee (FOMC) ended its November 1–2 meeting announcing its fourth consecutive 0.75 percentage point hike in federal funds. In the accompanying statement, the FOMC suggested a potential easing in subsequent rate hikes.

Stocks rallied on the news but did an abrupt reversal when Fed Chair Jerome Powell struck a much more hawkish tone in his post-meeting press conference. Losses accelerated into the following day, cementing a poor start to the new month.2

Inflation Report

The markets turned around the following week, however, when a lower-than-expected inflation report triggered the biggest one-day stock market gain in more than two years. The report revived hopes of a slowdown in the pace and size of future rate hikes. The tech-heavy Nasdaq gained 7.4 percent for the day.3

As the month progressed, public comments by Fed officials appeared to pour cold water on investors’ hopes. Despite these hawkish comments, stocks rallied during the holiday week and picked up momentum following the release of the FOMC meeting minutes the day before Thanksgiving.

Powell Confirms

The meeting minutes suggested that an imminent easing in rate hikes may be in the offing. The minutes revealed that most Fed officials felt a slowdown in the pace of rate hike increases was appropriate. Fed officials pointed to the growing risk that the Fed may increase rates beyond what was required to reduce inflation.

Stocks surged higher to close out the month after comments by Powell that the Fed was prepared to ease up on coming rate hikes.

Sector Scorecard

All 11 industry sectors were positive for the month, with gains in Communications Services (+6.85 percent), Consumer Staples (+6.12 percent), Energy (+1.28 percent), Financials (+6.86 percent), Health Care (+4.72 percent), Industrials (+7.81 percent), Materials (+11.70 percent), Real Estate (+6.83 percent), and Utilities (+6.96 percent). Elsewhere, Consumer Discretionary rose 1.49 percent and Technology added 6.33 percent.4

What Investors May Be Talking About in December 2022

In the month ahead, the financial markets will again focus on the Fed as it concludes its two-day meeting on December 14. November’s 0.75% increase in the federal funds rate marked the fourth consecutive 75 basis points hike since June.

Inflation appears to be trending lower, and the job market is showing signs of cooling, which may help influence the Fed’s decision. The Fed has prepared the financial markets for its next move, so it’s unlikely to change course.5

![]()

T I P O F T H E M O N T H

Remember that a major life event may mean a change in your retirement, tax, or estate planning approach.

![]()

World Markets

Overseas markets rallied in November as the MSCI-EAFE Index picked up 11.08 percent.6

In Europe, Italy gained 9.51 percent, and Germany rose 8.63 percent. Elsewhere, France added 7.53 percent, the U.K. tacked on 6.99 percent, and Spain advanced 5.11 percent.7

Pacific Rim markets were strong, with Australia climbing 6.13 percent and Japan adding 1.38 percent. China’s Hang Seng index had a sharp rally, picking up 26.62 percent.8

Indicators

Gross Domestic Product: The second reading of the third-quarter GDP was revised higher, to 2.9 percent from 2.6 percent.9

Employment: Employers continued to hire, with payrolls rising by 261,000 in October. While this is a strong number, it was down from 315,000 in September. The unemployment rate ticked higher to 3.7 percent, while average hourly earnings rose 4.7 percent from a year ago.10

Retail Sales: Retail sales rose 1.3 percent in October, helped by early discounting from retailers and purchases of building materials and home furnishings in the wake of Hurricane Ian.11

Industrial Production: Industrial production fell 0.1 percent, coming in lower than the consensus forecast of an increase of 0.1 percent.12

Housing: Housing starts declined by 4.2 percent in October, dragged down by single-family home starts, which reached their lowest level in nearly two-and-a-half years. The year-over-year decline was 8.8 percent13

October’s existing home sales fell 5.9 percent from their September levels and 28.4 percent from a year earlier as higher mortgage rates drove potential buyers out of the market. It was the ninth consecutive month that sales fell.14

New home sales unexpectedly jumped 7.5 percent in October, despite higher mortgage rates. Sales were down 5.8 percent from a year ago. The median price of a new home rose 15.4 percent from last October’s level.15

Consumer Price Index: Inflation moderated in October, rising 0.4 percent month-over-month, and coming in below market expectations of 0.6 percent. The 12-month rate remained elevated at 7.7 percent under the consensus estimate of 7.9 percent. Core inflation (excluding the energy and food sectors) was 0.3 percent month-over-month in October, which was lower than the projected 0.5 percent.16

Durable Goods Orders: Orders of goods expected to last three years or longer were up 1.0 percent, exceeding economists’ expectations of a 0.4 percent increase.17

![]()

Q U O T E O F T H E M O N T H

“A true investor welcomes volatility…a widely fluctuating market means that irrationally low prices will periodically be attached to solid businesses.”

WARREN BUFFETT

![]()

The Fed

The Federal Reserve announced a 0.75 percent rate hike in federal funds at the conclusion of its two-day November meeting of the Federal Open Market Committee (FOMC). In the statement accompanying the announcement, the FOMC said that future rate increases would take into account the cumulative monetary tightening to date and the lag in the impacts resulting from such tightening.

In his post-meeting press conference, Fed Chair Powell added that it was too soon to consider any slowdown in the pace of rate hikes and that the terminal rate may be higher than originally expected.18

In the November meeting minutes released just before Thanksgiving, Fed officials indicated that they were likely to slow the pace of rate hikes soon, suggesting that such slowing may begin with December’s meeting.19

Sources: Yahoo Finance, November 30, 2022.

Sources: Yahoo Finance, November 30, 2022.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

T H E M O N T H L Y R I D D L E

T H E M O N T H L Y R I D D L E

I went into the woods and got it. I sat down to seek it. I brought it home with me because I couldn’t find it. What is it?

LAST MONTH’S RIDDLE: I’m dressed in a golden jacket. I take it off abruptly, accompanied by a loud noise. When I do, I become larger, but I weigh less. What am I?

ANSWER: A kernel of corn – popping.

![]() Ivana Lotoshynski, CFP® may be reached at 973-227-3390 or ILotoshynski@peoplewealthmatters.com

Ivana Lotoshynski, CFP® may be reached at 973-227-3390 or ILotoshynski@peoplewealthmatters.com

https://peoplewealthmatters.com/

Know someone who could use information like this? Please feel free to send us their contact information via phone or email.

(Don’t worry – we’ll request their permission before adding them to our mailing list.)

![]()

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSEurofirst 300 Index comprises the 300 largest companies ranked by market capitalization in the FTSE Developed Europe Index. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. Established in January 1980, the All Ordinaries is the oldest index of shares in Australia. It is made up of the share prices for 500 of the largest companies listed on the Australian Securities Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The FTSE TWSE Taiwan 50 Index is a capitalization-weighted index of stocks comprising 50 companies listed on the Taiwan Stock Exchange developed by Taiwan Stock Exchange in collaboration with FTSE. The MSCI World Index is a free-float weighted equity index that includes developed world markets and does not include emerging markets. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The U.S. Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting, or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1. WSJ.com, November 30, 2022

2. WSJ.com, November 2, 2022

3. CNBC.com, November 10, 2022

4. SectorSPDR.com, November 30, 2022

5. FederalReserve.org, November 2022

6. MSCI.com, November 30, 2022

7. MSCI.com, November 30, 2022

8. MSCI.com, November 30, 2022

9. CNBC.com, November 30, 2022

10. WSJ.com, November 4, 2022

11. WSJ.com, November 16, 2022

12. MarketWatch.com, November 16, 2022

13. Finance.Yahoo.com, November 17, 2022

14. WSJ.com, November 18, 2022

15. Finance.Yahoo.com, November 23, 2022

16. CNBC.com, November 10, 2022

17. Nasdaq.com, November 23, 2022

18. WSJ.com, November 2, 2022

19. WSJ.com, November 23, 2022