Ivana Lotoshynski, CFP®

Ivana Lotoshynski, CFP®

People Wealth Matters

Financial Advisor

https://peoplewealthmatters.com

ilotoshynski@peoplewealthmatters.com

Monthly Market Insights | March 2024

U.S. Markets

Stocks notched solid gains last month as upbeat corporate reports and investor enthusiasm surrounding artificial intelligence overshadowed the Fed’s next move with interest rates.

The Dow Jones Industrial Average advanced by 2.22 percent, while the Standard & Poor’s 500 Index gained 5.17 percent. The Nasdaq Composite led, picking up by 6.12 percent.1

“Be more concerned with your character than your reputation, because your character is what you really are, while your reputation is merely what others think you are.”

Coach John Wooden, whose UCLA Bruins men’s basketball team won 10 NCAA national championships in a 12-year period, including a record seven in a row.

No Hurry

Early in the month, Federal Chairman Powell stated that there was no hurry to change the Fed’s interest rate policy. In the past, talk of interest rates remaining “higher for longer” had the potential to cause market volatility. This time, however, investors looked past Powell’s update and turned their attention to Q4 corporate reports.2

The Influence of AI

By mid-month, earnings news dominated the headlines as investors focused on any company that offered an update on artificial intelligence. Investors’ obsession with AI reached a fever pitch when the leading maker of AI-friendly semiconductors released its Q4 update.3

Nvidia’s market cap rose by $277 billion on the upbeat news, pushing it to a valuation of $2 trillion. To put that into perspective, Nvidia’s market cap is now roughly the same size as Canada’s economy. Its 16 percent gain following the company’s earnings report was the largest one-day market cap increase experienced by any U.S. company.3

Remember that the companies mentioned are discussed for illustrative purposes only. This should not be considered a solicitation for the purchase or sale of any company.

Q4 Corporate Updates

Corporate reports helped the market’s month-long rally. At last check, 73 percent of Standard & Poor’s 500 companies had reported actual Q4 earnings per share above estimated earnings per share. Wall Street saw this as an encouraging sign, leading to the fourth straight monthly gain in major averages.4

Shift in Leadership?

Since the current rally began in October 2023, mega-cap technology stocks have led the way. However, there are signs that leadership may be broadening out. Last month, the consumer discretionary sector posted the largest gain, while the tech sector finished in the middle of the pack.5

Sector Scorecard

Returns for all major sectors of the S&P 500 Index were in the green for the month. In an about-face from January, Industrials (+7.18 percent) and Consumer Discretionary (+7.89 percent) led, along with Materials (+6.51 percent). Technology (+4.70 percent) and Communications Services (+4.59 percent) were among the most modest gainers for the month, with Consumer Staples (+2.10 percent) and Utilities (+1.06 percent) finishing last but still in the positive.6

Yahoo Finance, February 29, 2024. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

What Investors May Be Talking About in March

Investor attention is expected to turn to the Fed’s two-day meeting, which ends on March 20th.

Back in December 2023, the Fed indicated that as many as three rate cuts were possible this year. However, during his recent February update, Federal Chairman Powell somewhat damped enthusiasm by stating that the Fed is continuing to look for further evidence that inflation is heading toward its 2 percent target.

January’s 2024 inflation reports came in a bit hotter than expected, seeming to support Powell’s position. The Fed may be reluctant to adjust rates if inflation stubbornly remains above the Fed’s target.7

Prior to the Fed’s meeting, February’s update on consumer prices will be released on March 12. Market watchers will be looking for clues in the report to anticipate the Fed’s next move.

World Markets

The MSCI EAFE Index rose 1.68 percent in February as a powerful move in Japan’s Nikkei 225 Index helped pace gains.8

In Europe, stocks were mixed. Italy picked up 5.97 percent and Germany tacked on 4.58. Meanwhile France and Spain posted losses for the month.9

The Pacific Rim markets were higher, paced by solid gains in China’s Hang Seng index as well as Korea and Japan.

With the help of positive corporate earnings and governance reforms, Japan’s Nikkei Index broke through its “iron ceiling”—the previous record high level set in 1989. It had become a notoriously significant psychological barrier over the past 3½ decades of economic stagnation. Japan has gained 17 percent year-to-date.10,11

Yahoo Finance, February 29, 2024. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Indicators

Gross Domestic Product (GDP)

The U.S. economy grew by a revised annualized rate of 3.2 percent in Q4 2023, slightly down from the initial estimate of 3.3 percent, mainly due to downgraded inventory investment. Consumer spending and government investment were revised upward, however.12

Employment

Employers added 353,000 jobs in January, nearly double the 185,000 jobs expected. January’s increase was higher than December’s revised job gains of 333,000. The unemployment rate remained at 3.7 percent for the second month in a row, while average hourly earnings increased by 0.6 percent—double the estimate for January.13

Retail Sales

Consumer spending fell by 0.8 percent in January, worse than the anticipated 0.3 percent decline in sales. This number contrasts with December’s 0.6 percent rise (a positive surprise), which came off a robust holiday shopping season. Year over year, retail sales declined by 0.2 percent.14

Industrial Production

Industrial output fell by 0.1 percent in January, adversely impacted by cold weather across the country. Economists expected a 0.2 percent increase.15

Housing

Housing starts fell 14.8 percent in January due to cold weather.16

Existing home sales rose by 3.1 percent in January, benefiting from a slight tick down in mortgage rates in November and December. The median sales price was up by 5.1 percent year over year.17

Consumer Price Index (CPI)

Consumer prices rose by 0.3 percent in January and were up by 3.1 percent for the 12 months. This was cooler than December’s year-over-year gain of 3.4 percent but warmer than the 2.9 percent gain expected by economists. Core prices, which exclude food and energy, increased by 0.4 percent in January, up by 3.9 percent year over year.18

Durable Goods Orders

Orders of manufactured goods designed to last three years or longer fell 6.1 percent in January. Orders were flat in December.19

The Fed

While there were no FOMC meetings in February, markets digested comments from the Federal Reserve’s two-day meeting that ended on January 31.

The Fed’s policy language, which was released after the meeting, indicated a subtle shift from considering rate cuts to proposing that such cuts could be possible unless inflation becomes a concern. The Fed’s funds rate remains within the 5.25–5.50 percent target range.20

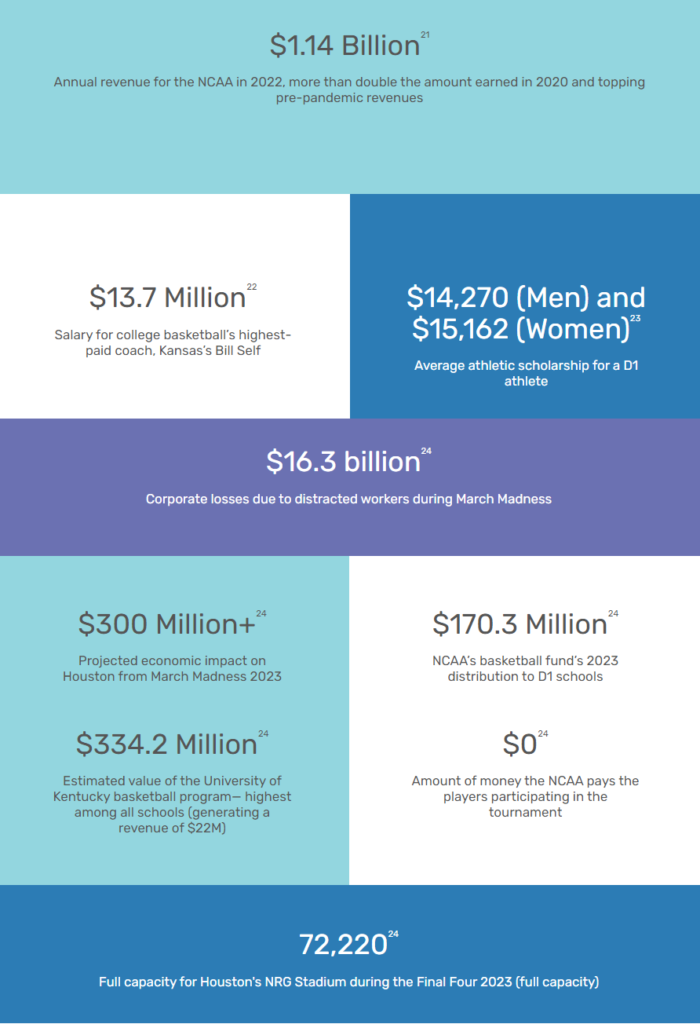

By the Numbers: March Madness

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, or state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Investing involves risks, and investment decisions should be based on your own goals, time horizon and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, timeframe, and risk tolerance.

The forecasts or forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The S&P 500 Composite Index is an unmanaged group of securities considered to be representative of the stock market in general. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The Russell 1000 Index is an index that measures the performance of the highest-ranking 1,000 stocks in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark for the performance in major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

The Hang Seng Index is a benchmark index for the blue-chip stocks traded on the Hong Kong Stock Exchange. The KOSPI is an index of all stocks traded on the Korean Stock Exchange. The Nikkei 225 is a stock market index for the Tokyo Stock Exchange. The SENSEX is a stock market index of 30 companies listed on the Bombay Stock Exchange. The Jakarta Composite Index is an index of all stocks that are traded on the Indonesia Stock Exchange. The Bovespa Index tracks 50 stocks traded on the Sao Paulo Stock, Mercantile, & Futures Exchange. The IPC Index measures the companies listed on the Mexican Stock Exchange. The MERVAL tracks the performance of large companies based in Argentina. The ASX 200 Index is an index of stocks listed on the Australian Securities Exchange. The DAX is a market index consisting of the 30 German companies trading on the Frankfurt Stock Exchange. The CAC 40 is a benchmark for the 40 most significant companies on the French Stock Market Exchange. The Dow Jones Russia Index measures the performance of leading Russian Global Depositary Receipts (GDRs) that trade on the London Stock Exchange. The FTSE 100 Index is an index of the 100 companies with the highest market capitalization listed on the London Stock Exchange.

Please consult your financial professional for additional information.

Copyright 2024 FMG Suite.

1. WSJ.com, February 29, 2024

2. Reuters.om, February 4, 2024

3. MarketWatch.com, February 22, 2024

4. Advantage.Factset.com, February 29, 2024

5. MarketWatch.com, February 29, 2024

6. SectorSPDR.com, February 29, 2024

7. WSJ.com, February 13, 2024

8. MSCI.com, February 29, 2024

9. MSCI.com,February 29, 2024

10. MSCI.com, February 29, 2024

11. CNBC.com, February 22, 2024

12. Reuters.com, February 28, 2024

13. CNBC.com, February 2, 2024

14. WSJ.com, February 16, 2024

15. WSJ.com, February 16, 2024

16. Census.gov, February 16, 2024

17. CNBC.com, February 22, 2024

18. CNBC.com, February 12, 2024

19. Reuters.com, February 26, 2024

20. CNBC.com, February 21, 2024

21. Wallethub.com, March 7, 2023

22. TheAthletic.com, November 7, 2023

23. Kiplinger.com, July 22, 2022

24. Wallethub.com, March 7, 2023